New York Property Search By Owner Name

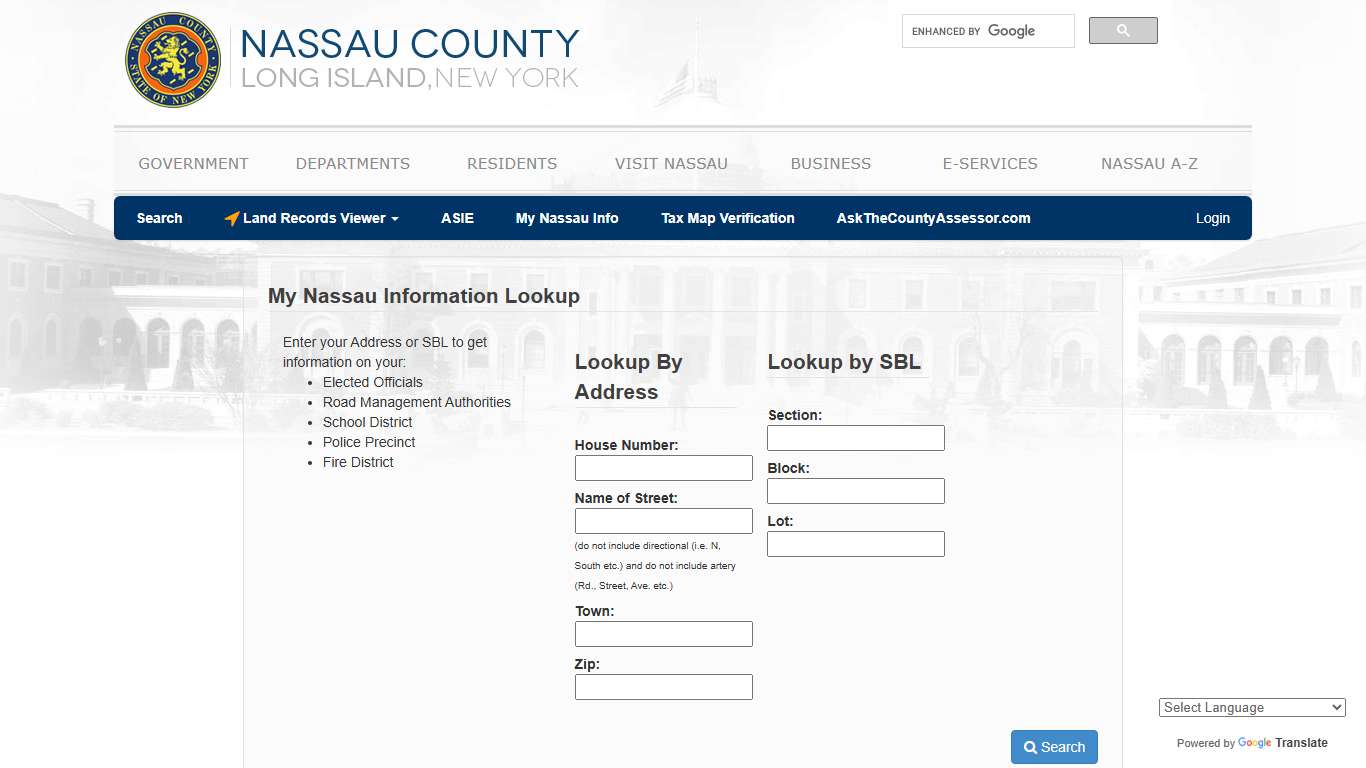

LandRecord Lookup

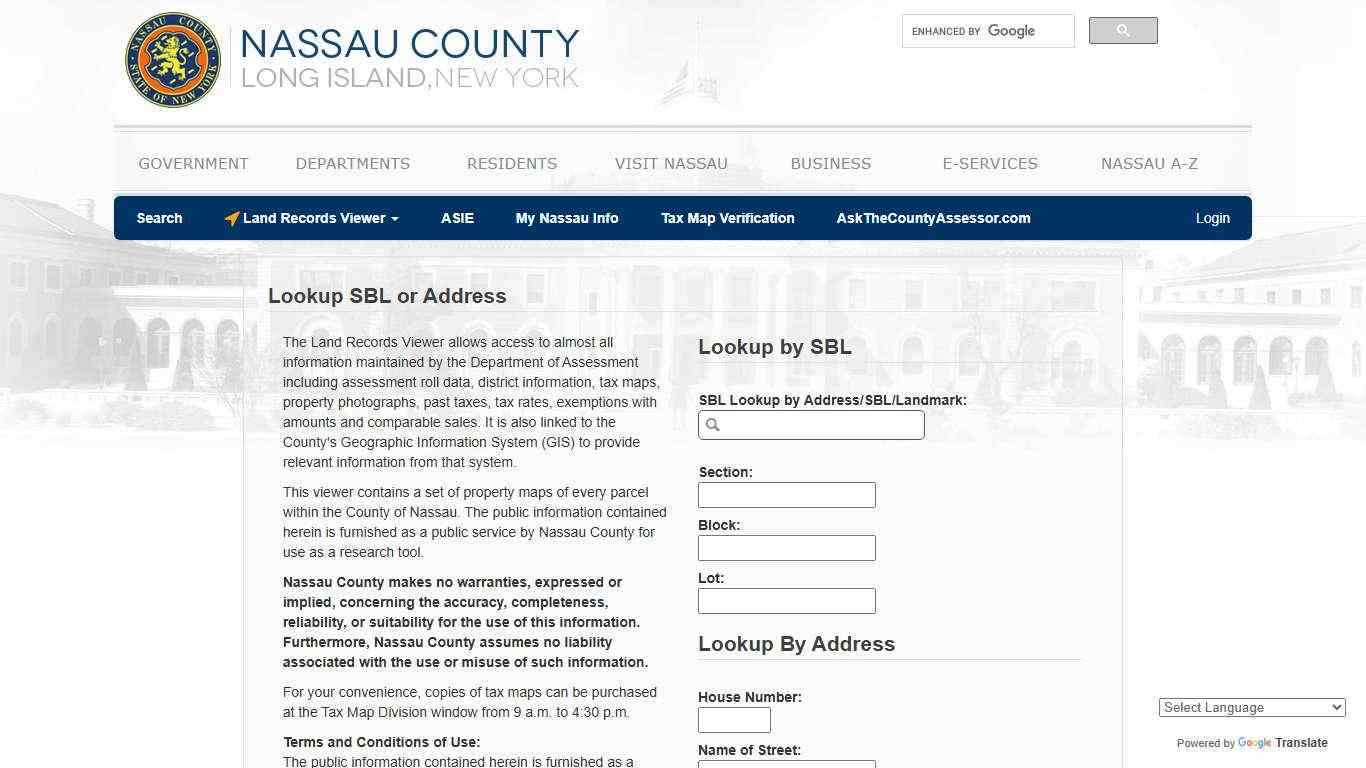

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data, district information, tax maps, property photographs, past taxes, tax rates, exemptions with amounts and comparable sales. It is also linked to the County's Geographic Information System (GIS) to provide relevant information from that system.

https://lrv.nassaucountyny.gov/

NETR Online • Public Records, Search Records, Property Tax, Property Search, Assessor

Public Records Online Directory The Public Records Online Directory is a Portal to those Tax Assessors', Treasurers' and Recorders' offices that have developed web sites for the retrieval of available public records over the Internet. Examples of records that can be accessed include deeds, mortgages, assessment data, tax details, and parcel maps.

https://publicrecords.netronline.com/

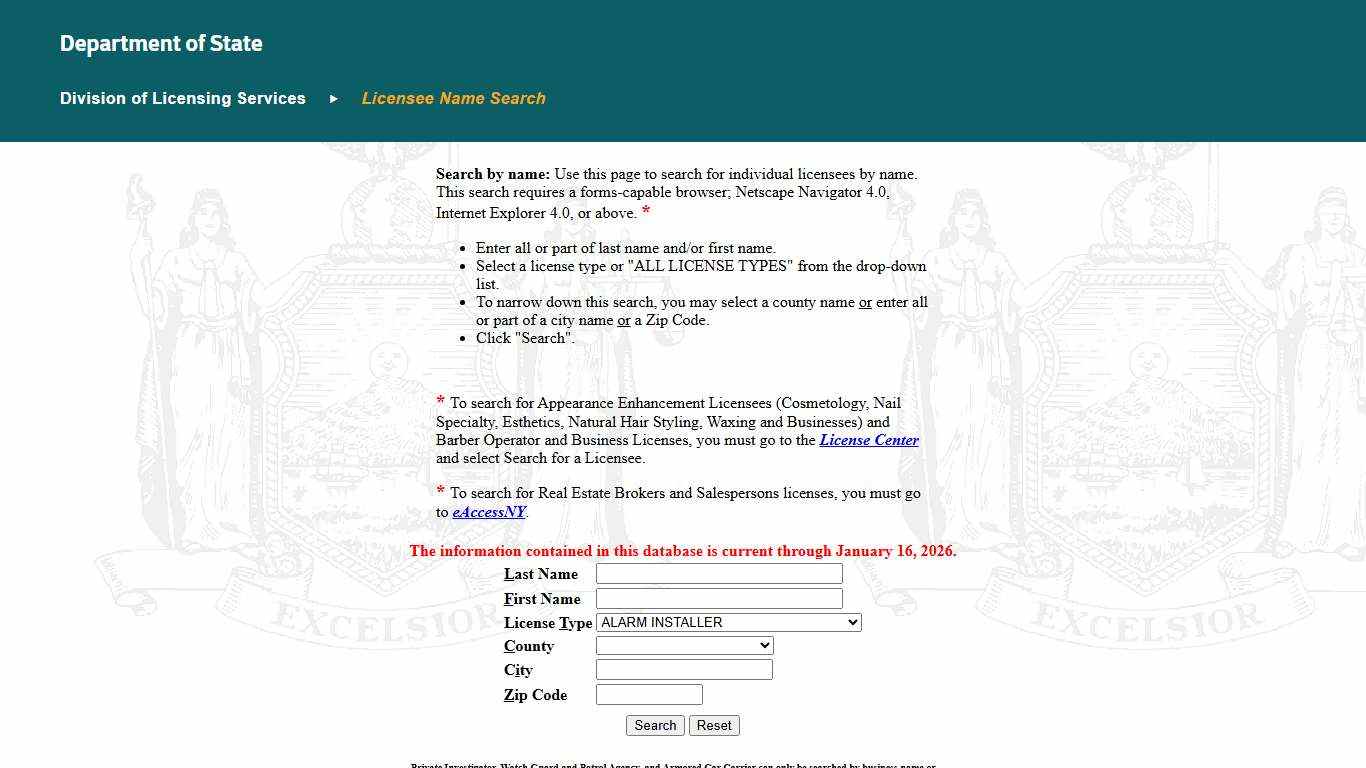

Licensee Name Search

The information contained in this database is current through January 16, 2026. Last Name. First Name. License Type. ALARM INSTALLER, APARTMENT INFORMATION ...

https://appext20.dos.ny.gov/lcns_public/lic_name_search_frm

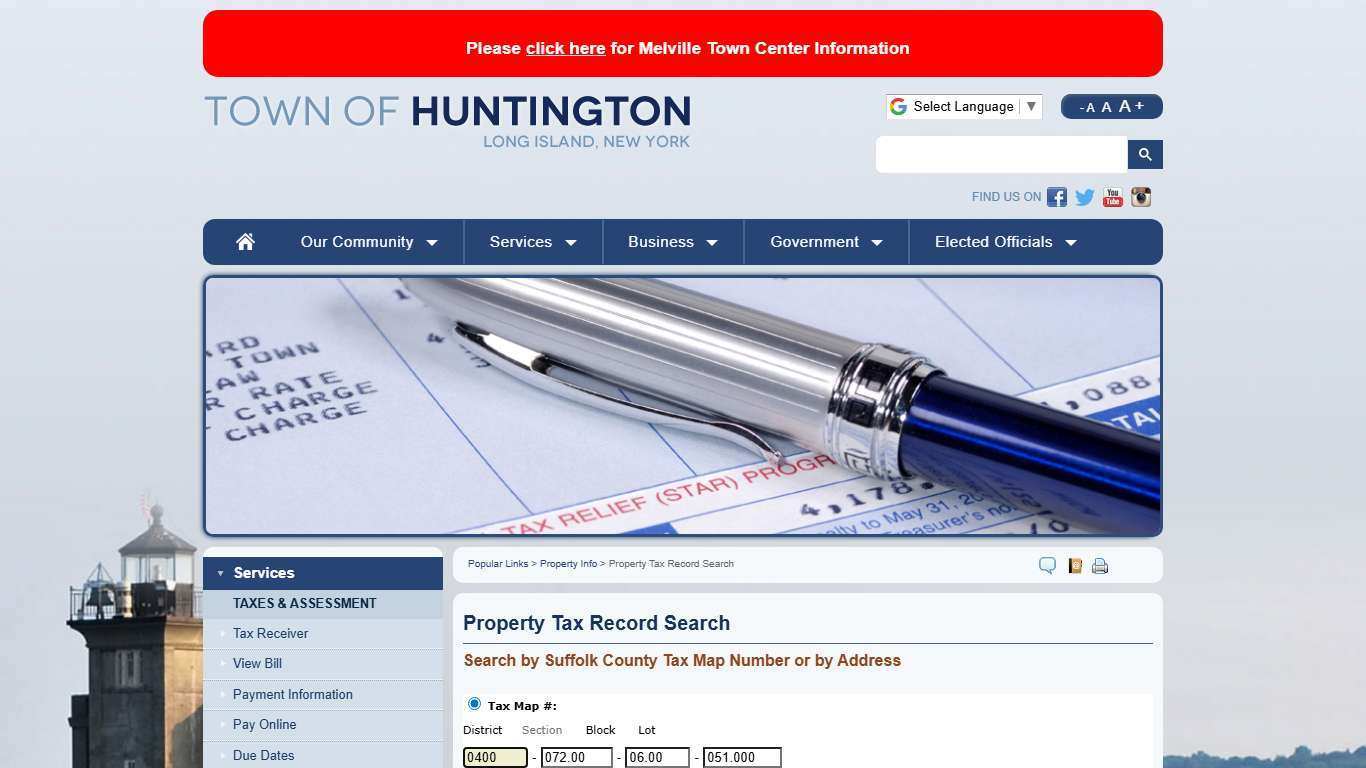

Property Tax Record Search - Town of Huntington, Long Island, New York

Rate this translation Your feedback will be used to help improve Google Translate...

https://www.huntingtonny.gov/taxlookup

PropertyShark - Property Data and Research Tools

Well-priced, well-located properties continued to attract significant attention from affluent buyers and investors in 2025. In this report, we broke down the top NYC residential sales, ranked by closing price. - Unlock a wide range of property data for all your real estate research needs and explore detailed property information, official documents, interactive maps and more: - Real owners, including behind LLCs - Owner phone numbers and conta...

https://www.propertyshark.com/mason/

Real Property Services | Oneida County

Real Property Services The Real Property Tax Services (RPTS) Division of the Finance Department ascertains, enters and extends taxes levied by the Board of Legislators for all County, town, and special district purposes. This includes unpaid village taxes, safety net charges (Utica and Rome), erroneous taxes, delinquent water and sewer rents, part-county delinquent sewer charges, and the preparation of the tax rolls for such taxes.

https://oneidacountyny.gov/departments/finance/real-property-services/

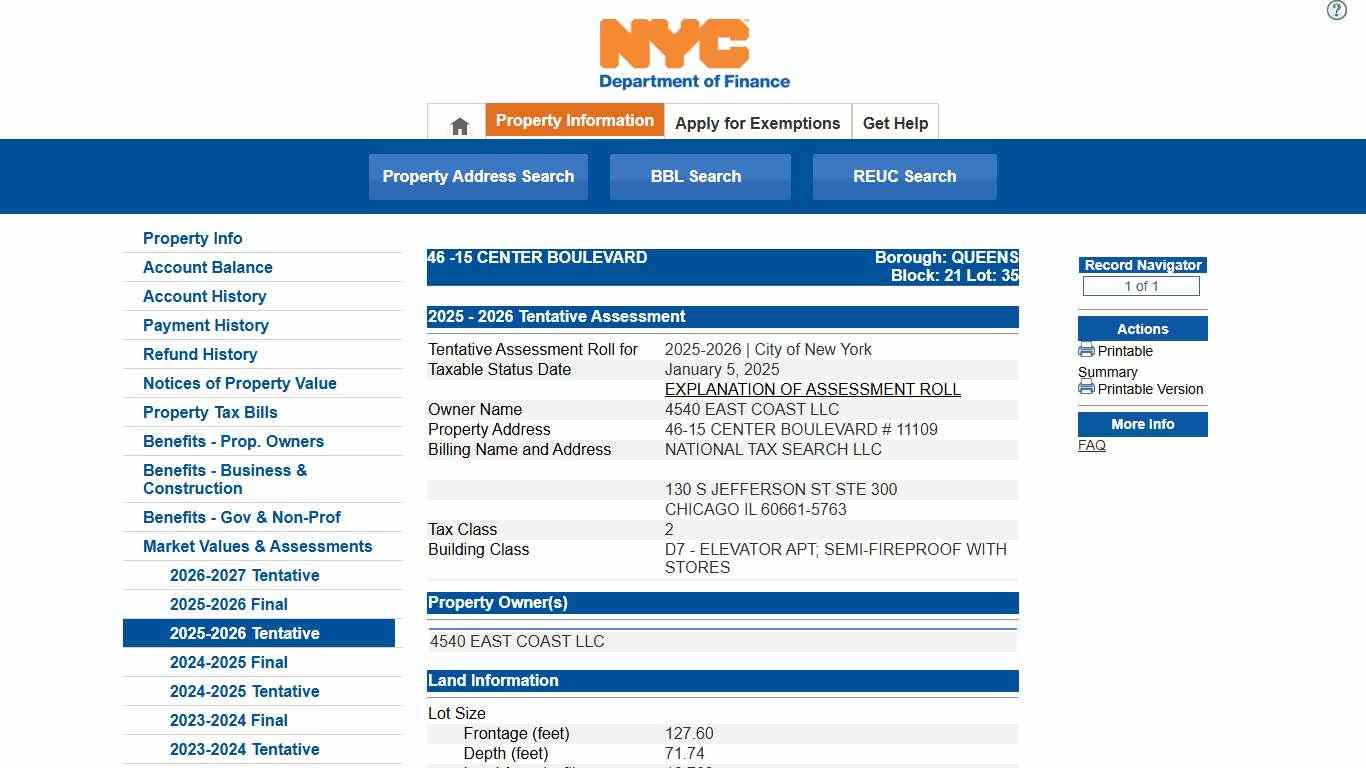

NYC Finance

City of New York. 2022 All Rights Reserved, NYC is a trademark and service mark of the City of New York Privacy Policy. Terms of Use.

https://a836-pts-access.nyc.gov/care/datalets/datalet.aspx?mode=asmt_tent_2026&UseSearch=no&pin=4000210035&jur=65&taxyr=2026&LMparent=20

Monroe County, NY - Real Property

39 W. Main Street Rochester, NY, 14614 Questions about taxes due for property? Call the Treasury Division at 585-753-1200 Real Property Portal The Monroe County Real Property Portal is provided as a service to the residents of our County. It is made available for residents to gain access to more information on their individual property as well as see information on taxes, historical sales and pay taxes online.

https://www.monroecounty.gov/property

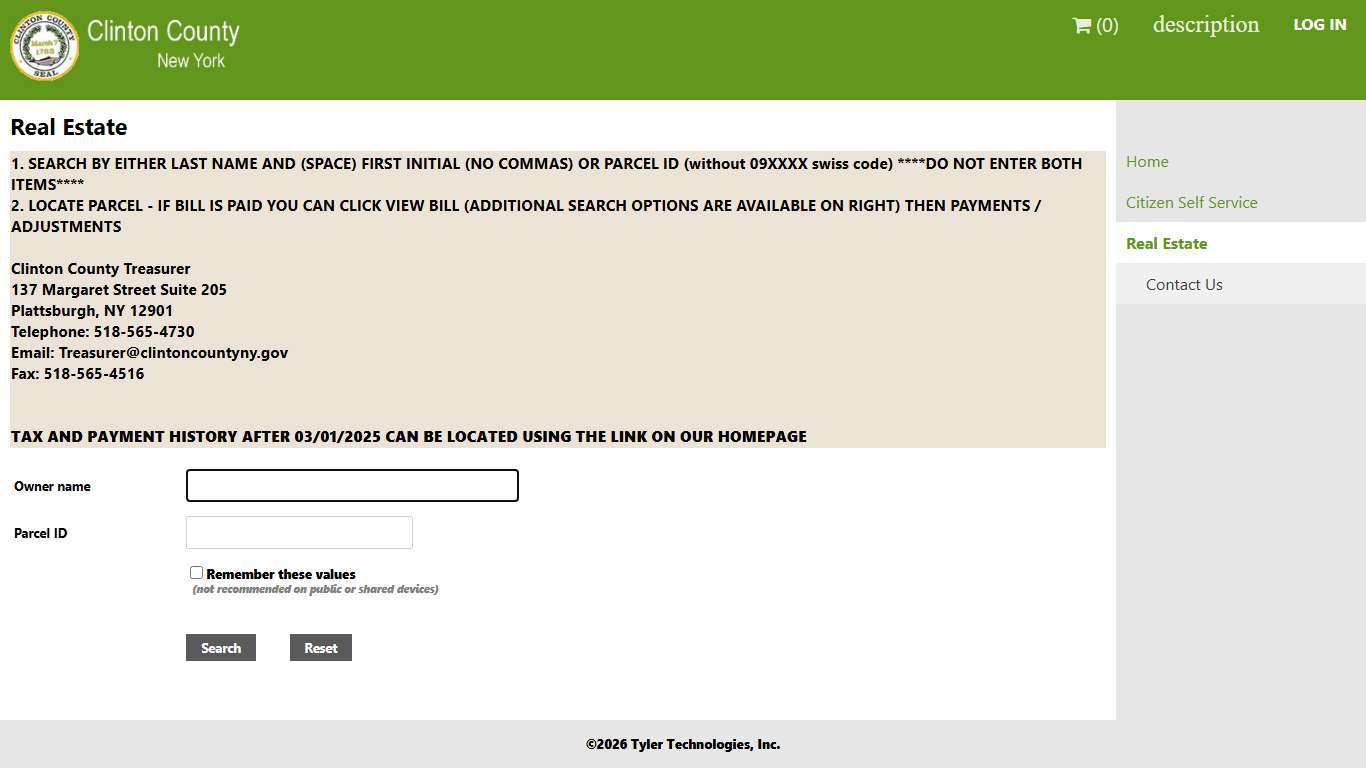

Real Estate Property Taxes

Real Estate. 1. SEARCH BY EITHER LAST NAME ... Owner name. Parcel ID. Remember these values (not recommended on public or shared devices). ©2026 Tyler ...

https://selfservice.clintoncountygov.com/css/citizens/RealEstate/Default.aspx?mode=new

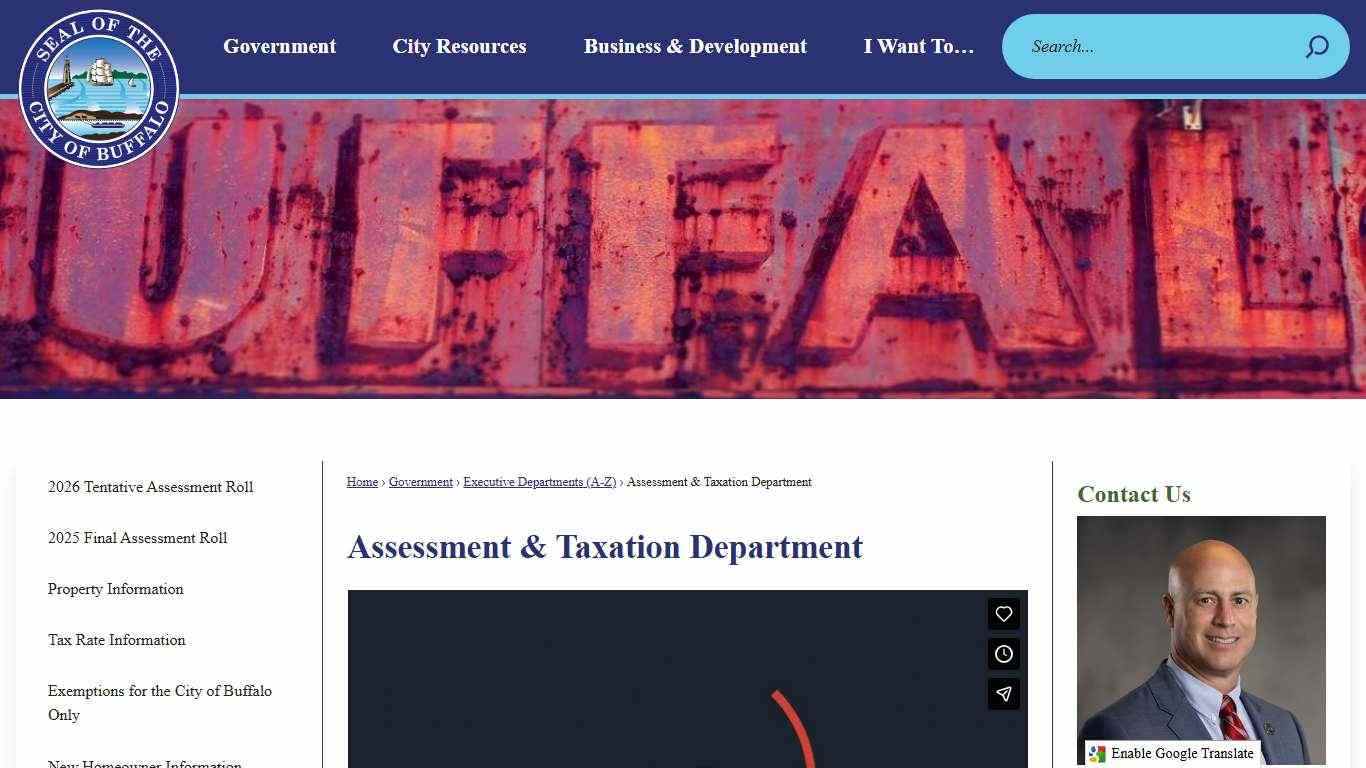

Assessment & Taxation Department | Buffalo, NY

Assessment & Taxation Department Description of Services Pursuant to the New York State Real Property Tax Law, The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo.

https://www.buffalony.gov/187/Assessment-Taxation-Department

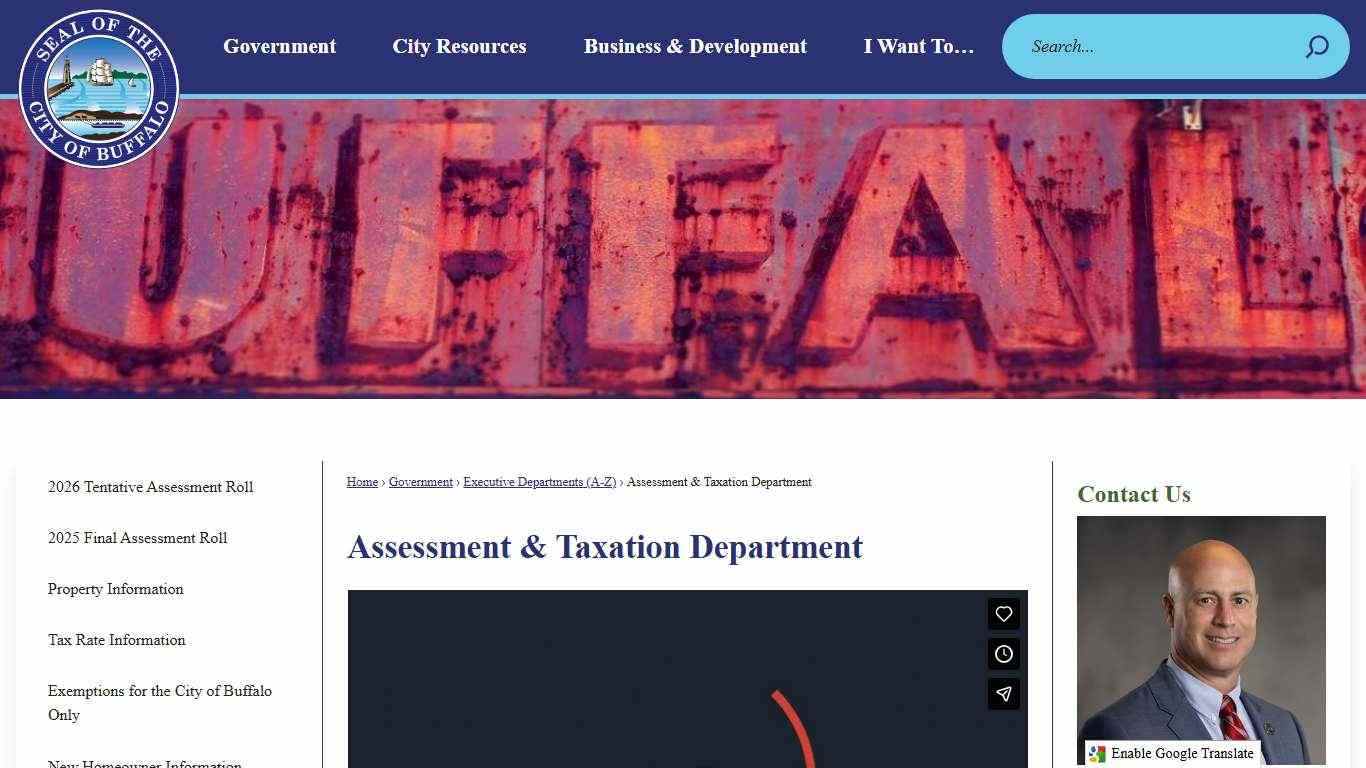

Assessment & Taxation Department | Buffalo, NY

Assessment & Taxation Department Description of Services Pursuant to the New York State Real Property Tax Law, The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo.

https://www.buffalony.gov/187/Assessment-Taxation-Department

LandRecord Lookup

Nassau County - Long Island, New York | Land Records Viewer. Government · Departments · Residents · Visit ... Lot: Search. © Copyright Nassau County, NY | 2026.

https://lrv.nassaucountyny.gov/mni/

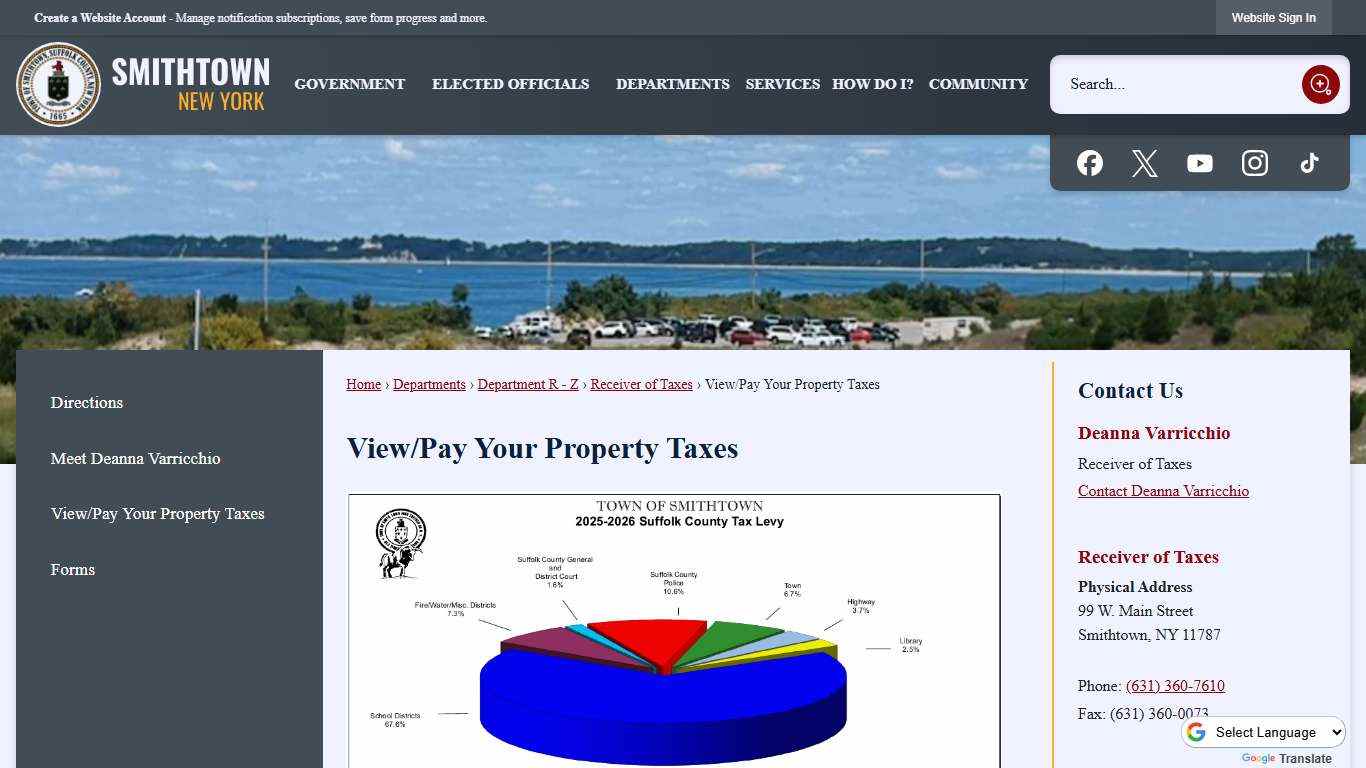

View/Pay Your Property Taxes | Smithtown, NY - Official Website

View/Pay Your Property Taxes The Office of the Receiver of Taxes welcomes you to the Town of Smithtown’s On-line Tax Lookup and Payment System. To facilitate payment please have your current tax bill in hand since you will be required to supply that information when payment is made.

https://www.smithtownny.gov/180/ViewPay-Your-Property-Taxes

Receiver of Taxes Office | Babylon, NY - Official Website

Receiver of Taxes Office Responsibilities of the Tax Receiver's Office The Receiver of Taxes is an elected official who administers and oversees the collection of yearly tax payments. The Receiver of Taxes Office is not a policy making office and does not determine tax rates.

https://www.townofbabylonny.gov/150/Receiver-of-Taxes-Office

Online Property Records Search | Morris County Clerk

DISCLAIMER: The email and text updates are informational only and should not be relied upon as the sole source of information by the user. The information does not represent legal advice nor should it be interpreted as such, and it is not all inclusive of available data on the topics presented.

https://www.morriscountyclerk.org/Services/Online-Property-Records-Search

Madison County Property Tax Inquiry

Madison County Property Tax Inquiry To search for tax information, you may search by the 15 to 18 digit parcel number, last name of property owner or site address. When searching, choose only one of the listed criteria. Do not enter information in all the fields.

https://madisonil.devnetwedge.com/

Department of State | Department of State

New York State's Downtown Revitalization Initiative (DRI) is transforming...

https://dos.ny.gov/

Tax Assessor - City of Jersey City

TO VIEW PROPERTY TAX ASSESSMENTS: 1. Go to www.taxrecords-nj.com 2. Left click on Records Search. 3. Under Tax Records Search, select Hudson County and Jersey City. 4. Under Search Criteria, type in either property location, owner’s name or block & lot identifiers. 5. To process, click on Submit Search. To view Jersey City Tax Rates and Ratios, read more here.

https://www.jerseycitynj.gov/residentresources/taxassessor

Receiver of Taxes | Brookhaven, NY

Receiver of Taxes 1st half tax payments are due on January 10, 2026. Since the 10th is a Saturday, our office will be open extra hours on January 12th from 8:00 am to 7:30pm to accept in-person payments. Online Tax Bill Lookup and Payment System Pay your taxes online.

https://www.brookhavenny.gov/328/Receiver-of-Taxes